UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

SCHEDULE 14A

(RuleRULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [ X ]

xFiled by a Party other than the Registrant [ ]¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

[ ]Preliminary

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Landauer, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement,

[ X ]Definitive Proxy Statement

[ ]Definitive Additional Materials

[ ]Soliciting Material Pursuant to §240.14a-12

[ ]Confidential, for Use of if other than the Commission Only (as permitted by Rule 14a-6(e)(2))Registrant)

| | | | |

Landauer Inc.

Payment of Filing Fee (Check the appropriate box): |

(Name of Registrant as Specified in Its Charter)

| |

| x | | No fee required. |

| |

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

Payment of Filing Fee (Check the appropriate box):

[ X ] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | (1) | | (1)Title of each class of securities to which transaction applies:

|

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | (3)

|

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set(set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1)Amount previously paid:

|

| (2)Form, schedule or registration statement no.:

|

LANDAUER, INC.

2 SCIENCE ROAD, GLENWOOD, ILLINOIS 60425-1586

TELEPHONE (708) 755-7000

January 12, 2016

Dear Landauer Stockholder:

On behalf of Landauer, Inc. (the “Company”), we are pleased to invite the stockholders of the Company to attend the Annual Meeting of Stockholders of Landauer, Inc., to be held on February 18, 2016, at 10:00 a.m., local time, at 8755 West Higgins Road, Chicago, Illinois.

Fiscal 2015 was a challenging year for the Company. Under David E. Meador’s leadership as Chairman of the Audit Committee, we worked aggressively to remediate all material control weaknesses identified in the Company’s 2014 Annual Report on Form 10-K. In addition, the Company replaced its financial leadership team by appointing a new Chief Financial Officer and a new Chief Accounting Officer in April 2015. More detail about the Company’s remediation efforts can be found in the Audit Committee Report in the Proxy Statement that this letter accompanies.

Under the leadership of Michael T. Leatherman and Michael P. Kaminski, we maintained focus on critical strategic initiatives and developed our long-term strategy during fiscal 2015. Our core strategy focuses on recurring revenue initiatives of higher margin products and services. We continued to make progress on our growth initiatives, including our next generation digital dosimeter platform, Verifii™ and are well positioned to meet the emerging needs for a broader radiation management solution. We are seeing strong demand for our solutions following the Joint Commission’s new Diagnostic Imaging requirements that became effective for hospitals and ambulatory care centers on July 1, 2015 and we believe this trend will continue to drive further growth opportunities and long-term value for stockholders.

To prepare the organization to fully execute our strategy, the Company made additional changes in its leadership. Effective October 1, 2015, Michael T. Leatherman stepped down as the Company’s President and Chief Executive Officer and was appointed to the new position of Executive Chairman of the Board. At the same time, Robert J. Cronin was appointed to the new position of Lead Director of the Board of Directors. With the resignation of Mr. Leatherman as President and Chief Executive Officer, the Board of Directors appointed Michael P. Kaminski as the Company’s new President and Chief Executive Officer. In addition, Jeffrey A. Bailey was appointed to the Board in April 2015. Mr. Bailey’s experience in the pharmaceutical industry and knowledge of the opportunities created by the new requirements of the Joint Commission will be beneficial as we execute our long-term strategy. More detail about all of these changes can be found in the Proxy Statement that this letter accompanies.

We have continued to improve corporate governance at the Company during fiscal 2015. We declassified the Board of Directors and adopted majority voting for directors in uncontested elections at the 2015 Annual Meeting. In addition, we modified our compensation design for long-term incentive awards by adding a Return on Invested Capital metric that further aligns management’s incentives with stockholder interests.

Your vote at the Annual Meeting is very important. Whether or not you plan to attend the meeting, we urge you to vote either via the Internet, by telephone or by signing and returning a proxy card. Please vote as soon as possible so that your shares will be represented.

Thank you for your continued support of Landauer.

Sincerely,

Michael T. Leatherman

Executive Chairman of the Board of Directors

Michael P. Kaminski

President and Chief Executive Officer

TABLE OF CONTENTS

LANDAUER, INC.

2 SCIENCE ROAD,

GLENWOOD, ILLINOIS 60425-1586

TELEPHONE (708) 755-7000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

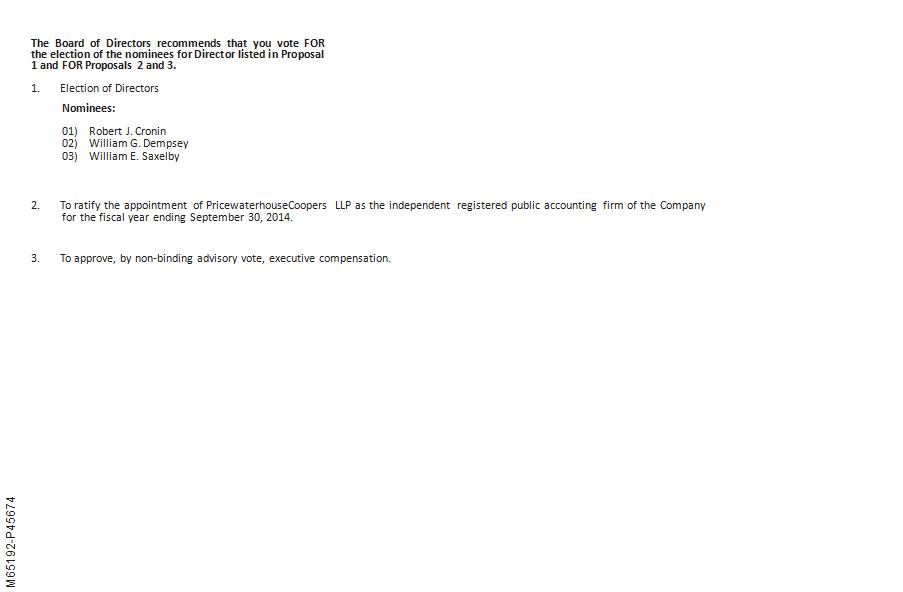

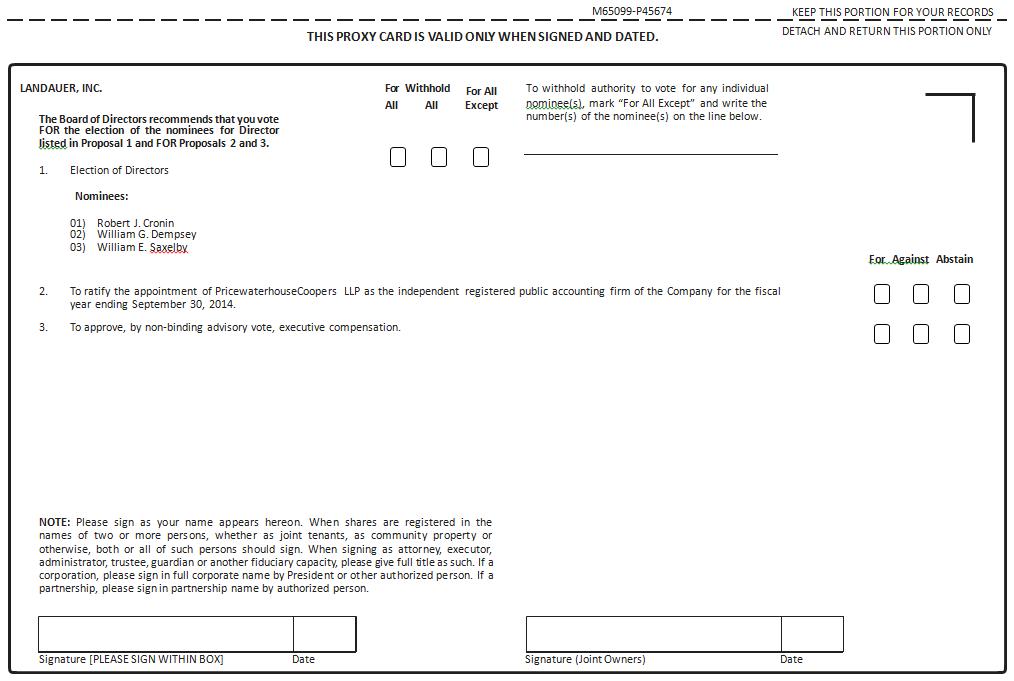

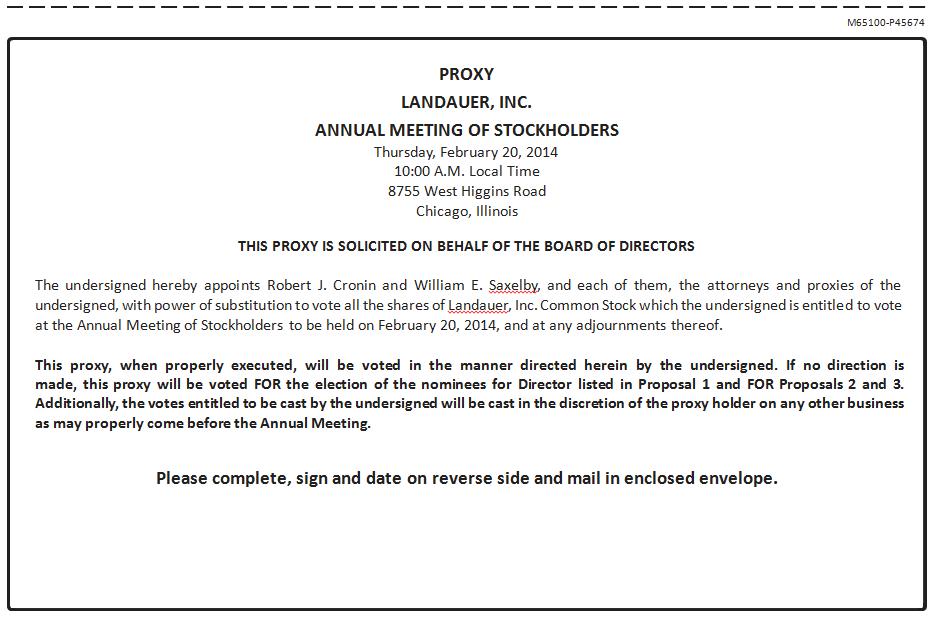

Notice is hereby given that the Annual Meeting of Stockholders of Landauer, Inc. will be held at 8755 West Higgins Road, Chicago, Illinois, at 10:00 a.m., local time, on Thursday, February 20, 201418, 2016 for the following purposes:

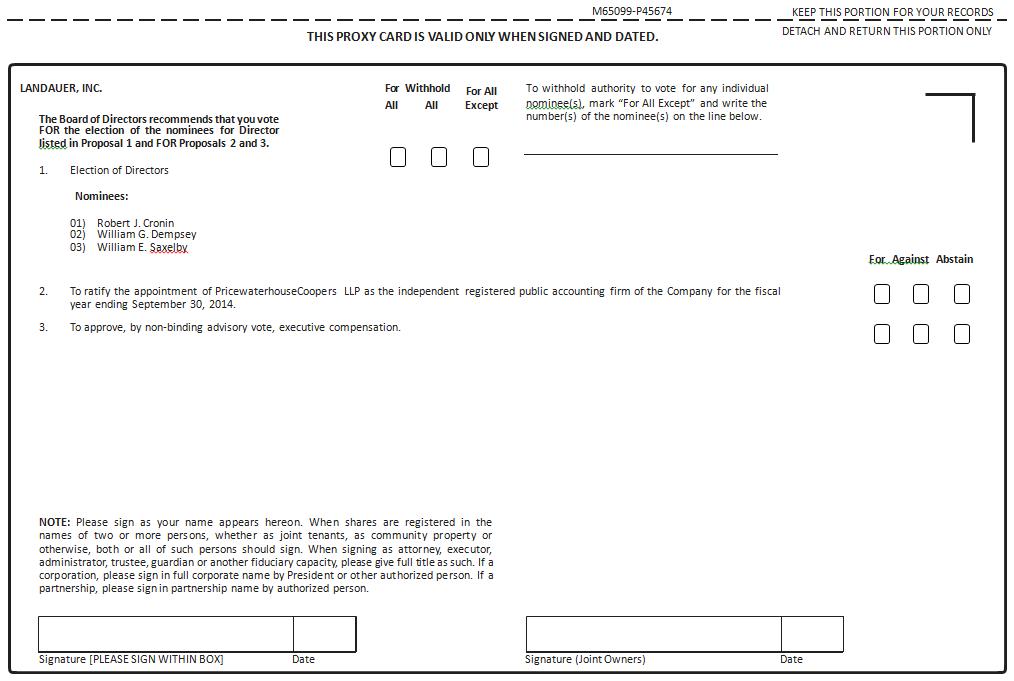

1.To re-elect the three directors identified in this Proxy Statement to hold office for an additional term of three years each.

| 2.

| |

| |

| | 1. | | To re-elect the four directors identified in this Proxy Statement to hold office for a term of one year each. |

| | |

| | 2. | | To vote on thea proposal to ratify the appointment of PricewaterhouseCoopersBDO USA, LLP, as the independent registered public accounting firm of the Company for the fiscal year ending September 30, 2014.2016. |

| 3.

| |

| | 3. | | To hold a non-binding advisory vote to approve executive compensation. |

| | |

| | 4. | | To vote on a proposal to approve the 2016 Landauer, Inc. Incentive Compensation Plan. |

| | |

| | 5. | | To transact such other business as may properly come before the meeting. |

4.To transact such other business as may properly come before the meeting.

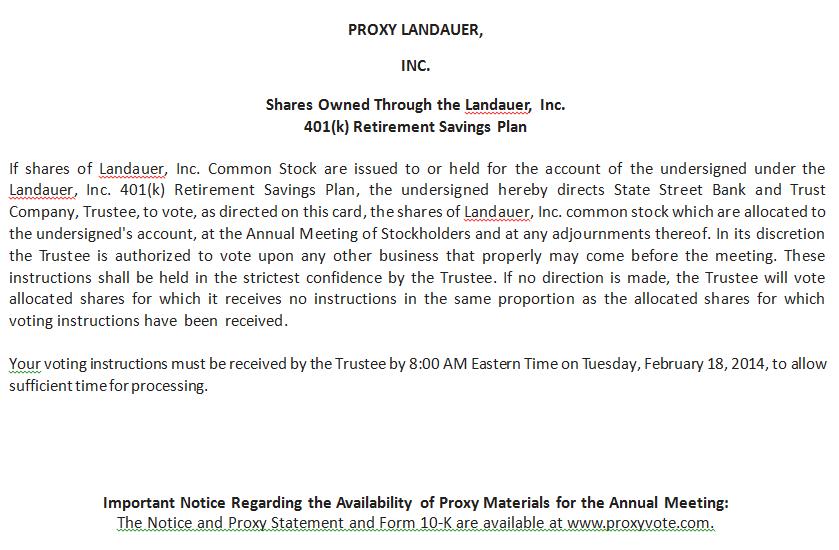

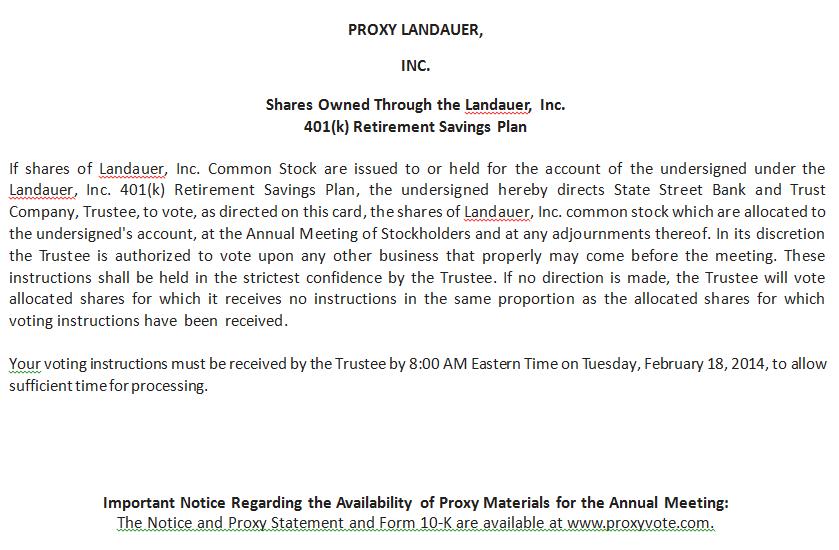

Only stockholders of record at the close of business on January 6, 2014December 31, 2015 are entitled to notice of and to vote at the meeting.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, THE COMPANY STRONGLY URGES YOU TO VOTE VIA THE INTERNET, TELEPHONE, OR REQUESTCOMPLETING AND RETURNING A PAPER PROXY CARD TO COMPLETE AND RETURN BY MAIL. IF YOU ATTEND THE MEETING AND VOTE IN PERSON, YOUR PROXY WILL NOT BE USED.

DANIEL J. FUJII

Vice President, Chief Financial Officer and Secretary

January 12, 2016

| | | | | | |

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: |

| | | |

| | VIA THE INTERNET Visit the web site listed on your proxy card | |

| | BY MAIL Sign, date and return your proxy card in the enclosed envelope |

| | | |

| | BY TELEPHONE Call the telephone number on your proxy card | |

| | IN PERSON Attend the Annual Meeting in Chicago, Illinois |

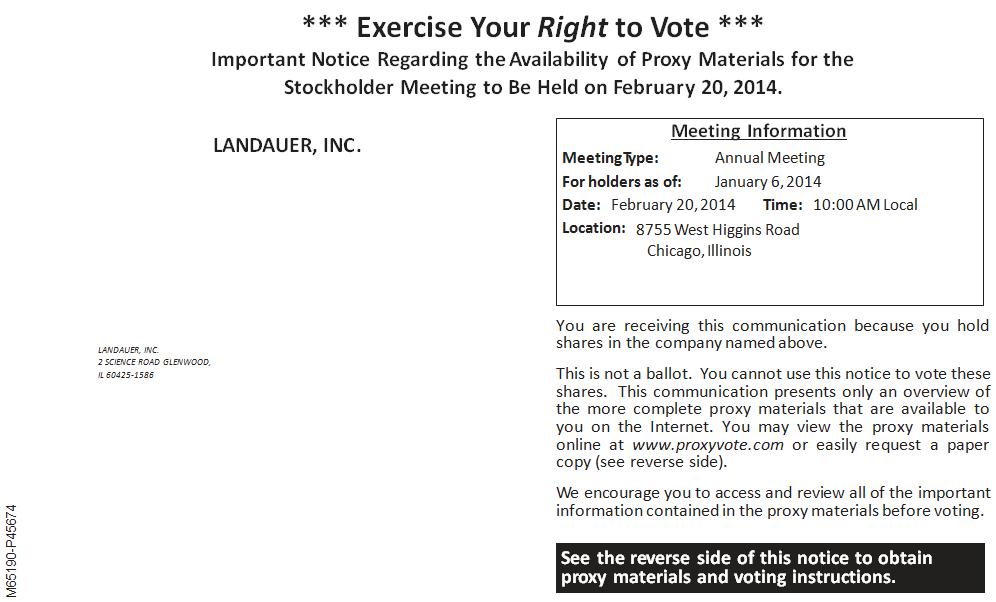

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on February 18, 2016.Our Proxy Statement and the Landauer, Inc. 2015 Annual Report on Form 10-K are available online atwww.proxyvote.com or at our investor relations website.

| | |

| |

Proxies and Voting Information | | PROXY STATEMENT |

PROXY STATEMENT SUMMARY

ANNUAL MEETING INFORMATION

We are providing this Proxy Statement to you in connection with the solicitation of proxies by the Board of Directors of Landauer, Inc. for the Annual Meeting of Stockholders and for any adjournment or postponement of the meeting (the “Annual Meeting”). We expect to begin mailing our proxy materials on or about January 12, 2016.

Time and Place: We are holding the Annual Meeting at 10:00 a.m. Central Standard Time on Thursday, February 18, 2016, at Landauer Inc., 8755 West Higgins Road, Chicago, Illinois.

Attendance Requirements: You may attend the Annual Meeting and vote in person even if you have returned a proxy in writing, by telephone or through the Internet.

Street-Name Holders: If you hold shares in a bank or brokerage account (known as shares held in “street name”), you must obtain a valid “legal proxy,” executed in your favor from the holder of record, if you wish to vote these shares at the meeting.

MICHAEL K. BURKEMatters for Stockholder Voting

Senior Vice President and Chief Financial OfficerAt this year’s Annual Meeting, we are asking our stockholders to vote on the following matters:

| | | | | | |

| | Proposal | | Board Recommendation | | Rationale for Board

Recommendation |

| 1. | | Election of Directors Jeffrey A. Bailey Michael P. Kaminski Michael T. Leatherman David E. Meador | |

| | • Broad mix of backgrounds with operating, financial & governance experience |

| 2. | | Ratification of Auditor Ratification of appointment of BDO USA, LLP | |

| | • Independent, with limited ancillary services |

| 3. | | Say-on-pay Advisory vote to approve the compensation for named executive officers | |

| | • Strong linkage of pay for performance • Balanced compensation program aligning interests with stockholders |

| 4. | | Approval of the 2016 Landauer, Inc. Incentive Compensation Plan | |

| | • Support executive retention and encourage executive stock ownership • Further align the interests of management and stockholders |

| | |

| | 1 |

| | |

| |

PROXY STATEMENT | | Information Concerning the Proxy Solicitation |

January 7, 2014

PROXY STATEMENT

APPROXIMATE DATE OF NOTICE: January 7, 2014JANUARY 12, 2016

INFORMATION CONCERNING THE PROXY SOLICITATION

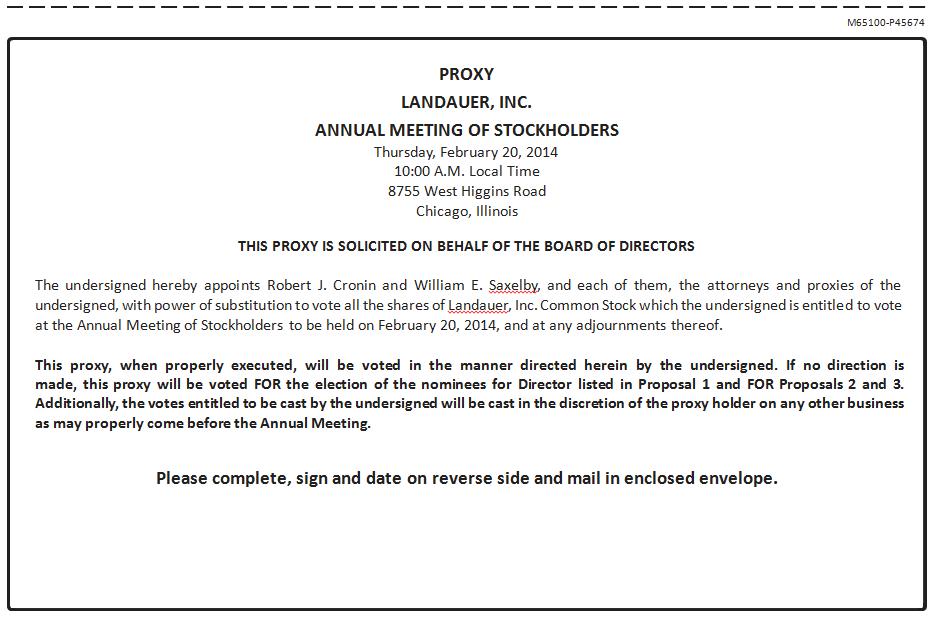

This proxy is solicited by the Board of Directors of Landauer, Inc. (the “Company”, “we”, “our”, “us” or “Landauer”) on behalf of the Company for use at its Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Thursday, February 20, 201418, 2016 at 8755 West Higgins Road, Chicago, Illinois, at 10:00 a.m., local time, or any adjournments or postponements thereof. You may revoke your proxy at any time prior to it being voted by giving written notice to the Corporate Secretary of Landauer, by submission of a later dated proxy or by voting in person at the meeting. The costs of solicitation will be paid by Landauer. Solicitations may be made by the officers and employees of Landauer personally or by telephone.

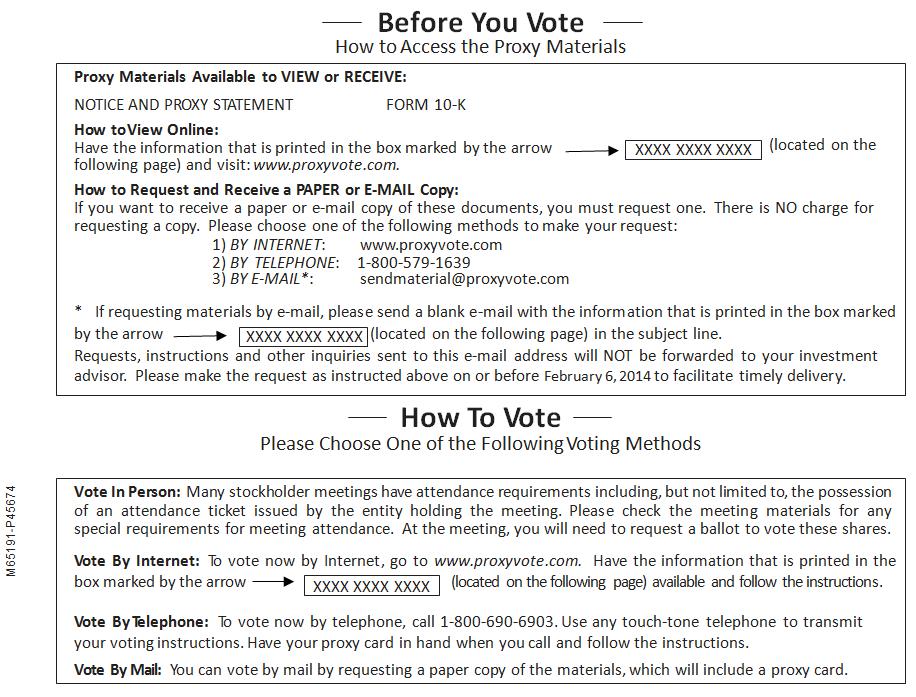

In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of its proxy materials to each stockholder of record, Landauer furnishes proxy materials on the Internet. You will not receive a printed copy of the proxy materials, unless specifically requested. This process is designed to expedite stockholders’ receipt of proxy materials, lower the cost of the Annual Meeting and help conserve natural resources.

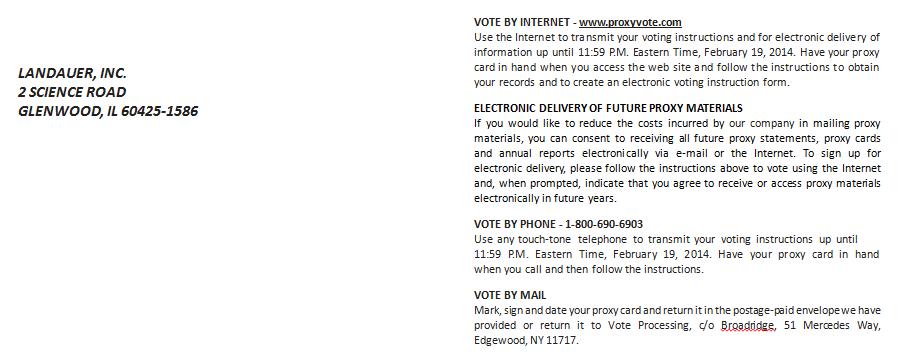

On or around January 7, 2014,12, 2016, the Company mailedwill mail to its stockholders, other than those who previously requested electronic or paper delivery, a Notice Regarding the Availability of Proxy Materials (the “Notice”), which contains instructions as to how you may access and review all of the Company’s proxy materials including the Proxy Statement and 20132015 Annual Report on Form 10-K, on10-K. The proxy card included with the Internet. The Notice alsomaterials instructs you as to how you may vote your proxy on the Internet or by telephone. However, if you would prefer to receive printed proxy materials, please follow

The rules of the instructions for requesting such materials as contained in the Notice.

The SEC’s rulesU.S. Securities and Exchange Commission (the “SEC”) permit the Company to deliver a single Notice or set of Annual Meeting materials to one address shared by two or more of the Company’s stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, Landauer has delivered only one Notice or set of Annual Meeting materials to multiple stockholders who share an address, unless the Company received contrary instructions from the impacted stockholders prior to the mailing date. Landauer agrees to deliver promptly, upon written or oral request, a separate copy of the Notice or Annual Meeting materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the Notice or Annual Meeting materials, contact Broadridge, Householding Department, at 51 Mercedes Way, Edgewood, NY 11717, or by telephone at 800-542-1061. If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future Notices or Annual Meeting materials for your household, please contact Broadridge at the above phone number or address.

On December 31, 2013,2015, Landauer had outstanding 9,538,0229,581,743 shares of Common Stock, which is its only class of voting stock, held of record by 272232 holders. Only stockholders of record at the close of business on January 6, 2014December 31, 2015 will be entitled to receive notice of and to vote at the meeting and any adjournments or postponements thereof. With respect to all matters that will come before the meeting, each stockholder may cast one vote for each share registered in his or her name on the record date.

The shares represented by every proxy received will be voted, and where a choice has been specified, the shares will be voted in accordance with the specification so made. If no choice has been specified on the proxy that has been signed and returned, the shares will be voted FOR the election of the nominees as directors, and, FOR the ratification of the appointment of PricewaterhouseCoopersBDO USA, LLP (“BDO”), as the independent registered public accounting firm. firm, FOR the approval of our compensation for named executive officers and FOR the approval of the 2016 Landauer, Inc. Incentive Compensation Plan.

The proxy also gives authority to the proxies to vote the shares at their discretion on any other matter presented at the meeting. If a proxy indicates that all or a portion of the shares represented by such proxy are not being voted with respect to a particular proposal, such non-voted shares will not be considered present and entitled to vote on such proposal, although such shares may be considered present and entitled to vote on other proposals and will count for the purpose of determining the presence of a quorum. An abstention with respect to a proposal has the effect of a vote against a proposal. “Brokerproposal, other than with respect to the proposal to elect directors. Abstentions will have no effect on the proposal to elect directors.

“Broker non-votes” are counted toward the quorum requirement but they do not affect the determination of whether a matter is approved. A broker non-vote occurs when a broker cannot vote on a matter because the broker has not received instructions from the beneficial owner and lacks discretionary voting authority with respect to that matter. It is expected that brokers will lack discretionary voting authority with respect to the election of nominees as directors, the approval of our compensation program for named executive officers and the proposal relating to the approval of the performance measures under the Company’s incentive

compensation plan,2016 Landauer, Inc. Incentive Compensation Plan, but will not lack discretionary voting authority with respect to the proposal regarding ratification of the independent registered public accounting firm at the Annual Meeting.

| | |

| 2 | |  |

| | |

| |

Beneficial Ownership of Common Stock | | PROXY STATEMENT |

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table provides information as of November 30, 2013December 31, 2015 concerning beneficial ownership of Common Stock by each person known by Landauer to own beneficially more than 5% of the outstanding shares of Common Stock, each director, each director nominee, each executive officer named under the caption “Executive Compensation” and all directors and executive officers as a group. Unless otherwise noted, the listed persons have sole voting and dispositive powers with respect to shares held in their names, subject to community property laws, if applicable. Percentage ownership is based on an aggregate 9,581,743 shares of Common Stock outstanding on December 31, 2015. Unless otherwise noted, the address of each beneficial owner is c/o Landauer, Inc., 2 Science Road, Glenwood, Illinois60425-1586.

| | |

| | |

Name of Beneficial Owner | Number of Shares Beneficially Owned | Percent of Class |

Royce & Associates, LLC (1) | 974,471 | 10.2% |

T. Rowe Price Associates, Inc. (2) | 762,860 | 8.0% |

BlackRock, Inc. (3) | 729,648 | 7.6% |

The Vanguard Group, Inc. (4) | 568,761 | 5.9% |

William E. Saxelby (5) | 121,763 | 1.3% |

R. Craig Yoder (6) | 45,432 | * |

Robert J. Cronin (7) | 23,469 | * |

Thomas M. White | 11,395 | * |

Michael K. Burke | 11,010 | * |

Stephen C. Mitchell | 10,794 | * |

Michael T. Leatherman | 9,714 | * |

William G. Dempsey | 8,819 | * |

David E. Meador | 8,740 | * |

Michael R. Kennedy | 6,566 | * |

Michael P. Kaminski | 6,148 | * |

| | * |

All directors and executive officers as a group (14 persons) (8) | 272,112 | 2.8% |

*Less than one percent.

(1)As reported in a statement on Schedule 13G filed with the Securities and Exchange Commission on February 28, 2013. This stockholder’s address is 745 Fifth Avenue, New York, NY 10151.

(2)As reported in a statement on Schedule 13G filed with the Securities and Exchange Commission on February 14, 2013. Includes 555,500 shares owned by the T. Rowe Price Small Cap Value Fund, Inc. T. Rowe Price Associates expressly disclaims beneficial ownership of such securities. This stockholder’s address is 100 East Pratt Street, Baltimore, MD 21202.

(3)As reported in a statement on Schedule 13G filed with the Securities and Exchange Commission on February 4, 2013. This stockholder’s address is 40 East 52nd Street, New York, NY 10022.

(4)As reported in a statement on Schedule 13G filed with the Securities and Exchange Commission on January 29, 2013. Includes 12,768 shares for which Vanguard Fiduciary Trust Company (“VFTC”), a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner, as a result of serving as investment manager of collective trust accounts. VFTC directs the voting of these shares. This stockholder’s address is 100 Vanguard Boulevard, Malvern, PA 19355.

(5)Includes 50,000 shares subject to options exercisable within 60 days after November 30, 2013.

(6)Includes 6,000 shares subject to options exercisable within 60 days after November 30, 2013.

(7)Includes 1,500 shares subject to options exercisable within 60 days after November 30, 2013.

(8)Includes 57,500 shares subject to options exercisable within 60 days after November 30, 2013.

2

| | | | | | | | |

| Name of Beneficial Owner | | Number of Shares

Beneficially

Owned | | | Percent

of Class | |

Royce & Associates, LLC(1) | | | 1,060,400 | | | | 11.1 | % |

BlackRock, Inc.(2) | | | 1,040,165 | | | | 10.9 | % |

The Vanguard Group, Inc.(3) | | | 673,391 | | | | 7.0 | % |

RidgeWorth Capital Management LLC as Parent Company for Ceredex Value Advisors LLC(4) | | | 641,851 | | | | 6.7 | % |

R. Craig Yoder | | | 36,625 | | | | * | |

Robert J. Cronin | | | 26,950 | | | | * | |

Thomas M. White | | | 16,376 | | | | * | |

Stephen C. Mitchell | | | 15,775 | | | | * | |

William G. Dempsey | | | 13,800 | | | | * | |

David E. Meador | | | 13,721 | | | | * | |

Michael T. Leatherman | | | 12,789 | | | | * | |

Michael P. Kaminski | | | 7,434 | | | | * | |

Michael R. Kennedy | | | 6,049 | | | | * | |

G. Douglas King | | | 5,957 | | | | * | |

Daniel J. Fujii | | | 4,459 | | | | * | |

Jeffrey A. Bailey | | | 2,724 | | | | * | |

Mark A. Zorko | | | 2,000 | | | | * | |

All directors and executive officers as a group (13 persons) | | | 164,659 | | | | 1.7 | % |

| (1) | As reported in a statement on Schedule 13G filed with the Securities and Exchange Commission on January 13, 2015. This stockholder’s address is 745 Fifth Avenue, New York, NY 10151. |

| (2) | As reported in a statement on Schedule 13G filed with the Securities and Exchange Commission on July 10, 2015. This stockholder’s address is 55 East 52nd Street, New York, NY 10055. |

| (3) | As reported in a statement on Schedule 13G filed with the Securities and Exchange Commission on February 10, 2015. Includes 13,150 shares for which Vanguard Fiduciary Trust Company (“VFTC”), a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner, as a result of serving as investment manager of collective trust accounts. VFTC directs the voting of these shares. This stockholder’s address is 100 Vanguard Boulevard, Malvern, PA 19355. |

Section 16(a) Beneficial Ownership Reporting Compliance

| (4) | As reported in a statement on Schedule 13G filed with the Securities and Exchange Commission on February 12, 2015. This stockholder’s address is 3333 Piedmont Road NE, Suite 1500, Atlanta, GA 30305. |

| | |

| | 3 |

| | |

| |

PROXY STATEMENT | | Beneficial Ownership of Common Stock |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires Landauer’s officers and directors and persons who beneficially own more than ten percent of Landauer’s Common Stock (“Reporting Persons”) to file reports of beneficial ownership and changes in such ownership with the SEC. Reporting Persons are required by SEC regulation to furnish Landauer with copies of all Section 16(a) reports they file and Landauer is required to post such reports on its website,http://www.landauer.com.

Based solely on a review of the Forms 3, 4 and 5 filings received from, or filed by Landauer on behalf of, Reporting Persons since the beginning of fiscal year 2013, Landauer2015, the Company believes that all Section 16(a) filing requirements were met during fiscal year 2013.2015.

| | |

| 4 | |  |

| | |

| |

Election of Directors | | PROXY STATEMENT |

ELECTION OF DIRECTORS

Members ofIn December 2014, Landauer’s Board of Directors are divided into three classes serving staggered three-year terms,approved an amendment to the Company’s by-laws to change the election of directors to the Board in uncontested elections from plurality to majority voting. Only directors that receive a majority of the votes cast “FOR” their election will be elected. Abstentions and broker non-votes with a totalrespect to the election of nine directors authorized. No Director will standnot affect the outcome of the election of directors. In the event that an incumbent director is not re-elected, the Company’sGovernance and Nominating Standardsrequire that director to tender his or her resignation for consideration by the Governance and Nominating Committee. The Governance and Nominating Committee will recommend to the Board of Directors whether to accept or reject the resignation, or whether other action should be taken. The Board of Directors will act on the resignation and publicly disclose its decision regarding the resignation and the rationale behind the decision within 90 days following certification of the election after their 72nd birthday.results.

At the Annual Meeting of Stockholders of the Company held on March 6, 2015, the Company’s stockholders approved an amendment to the Certificate of Incorporation of the Company to declassify the Board of Directors. The terms of threefour of the seveneight current directors expire at the Annual Meeting. The threeThese directors, Robert J. Cronin, William G. DempseyJeffrey A. Bailey, Michael P. Kaminski, Michael T. Leatherman and WilliamDavid E. Saxelby,Meador, are Landauer’s nominees for re-election to a three-year term.one-year term each.

Effective April 15, 2015, the Board of Directors appointed Jeffrey A. Bailey as an independent director of the Board, increasing the size of the Board to seven individuals. Mr. Bailey was recommended as a nominee by an outside search firm, which had been retained by the Governance and Nominating Committee to assist it in identifying possible director candidates. On August 25, 2015, the Board of Directors appointed Michael P. Kaminski as the Company’s President and Chief Executive Officer, and as a member of the Board of Directors, with both appointments effective on October 1, 2015. In connection with the appointment of Mr. Kaminski as a member of the Board of Directors, the Board approved the increase in the size of the Board from seven to eight effective October 1, 2015.

Landauer’s by-laws provide that nominations for directorships by stockholders only may be made pursuant to written notice received at the Company’s principal office not less than 90, and not more than 120, calendar days prior to the first anniversary of the preceding year’s annual meeting. No such nominations were received for the meeting as of November 23, 2013.this year’s deadline.

Proxies may not be voted for a greater number of persons than the threefour named nominees. Directors are elected by a plurality of the votes present in person or represented by proxy at the meeting and entitled to vote on the election of directors. Thus, assuming a quorum is present, the three persons receiving the greatest number of votes will be elected to serve as directors. Accordingly, withholding authority to vote for a director and broker non-votes with respect to the election of directors will not affect the outcome of the election of directors. If a nominee should become unavailable for election, the persons voting the accompanying proxy may at their discretion vote for a substitute.

| | |

|

| Election of Directors |

| |

| | The Board of Directors recommends a vote FOR the election of Mr. Bailey, Mr. Kaminski, Mr. Leatherman and Mr. Meador as directors of Landauer. |

The Board of Directors recommends a vote FOR the re-election of Mr. Cronin, Mr. Dempsey and Mr. Saxelby as directors of Landauer.

Certain information as to the threefour nominees for re-election at the Annual Meeting and each other person whose term of office as a director will continue after the meeting is set forth below. Certain individual qualifications, experiences and skills of the directors that contribute to the Board of Directors’ effectiveness as a whole are also described below. The nominees for re-election at the meeting are Mr. Cronin, Mr. Dempsey and Mr. Saxelby.

| | |

| | 5 |

| | |

| |

PROXY STATEMENT | | Election of Directors |

DIRECTOR NOMINEES:

Jeffrey A. Bailey, age 53, has been a director since April 2015. Since January 2013 through September 2015, Mr. Bailey served as President and Chief Executive Officer and a Director of Lantheus Medical Imaging, Inc., a global leader in providing diagnostic imaging agents, primarily used for the diagnosis of cardiovascular diseases. From August 2011 to December 2012, Mr. Bailey was Chief Operating Officer of Fougera Pharmaceuticals (formerly Nycomed US), a company that develops, manufactures and markets specialty topical and dermatology medicines. From August 2010 to July 2011, he was Chief Commercial Officer of King-Pfizer Pharmaceuticals, a diversified specialty pharmaceutical discovery and clinical development company, and from 2008 to 2010, Mr. Bailey was President and General Manager of Novartis NorthWest Operating Unit. From 1984 to 2006, Mr. Bailey held various executive, commercial and manufacturing roles within the Johnson & Johnson family of companies. Mr. Bailey serves on the Audit and Compensation Committees.

3Qualifications: Mr. Bailey’s extensive experience in the pharmaceutical industry combined with a broad range of functional leadership experience provides valuable insight for the Company as to the issues and opportunities created by the Joint Commission’s new Diagnostic Imaging Services Requirements associated with the safe delivery of diagnostic imaging services. He also has strong functional experience in manufacturing, supply chain, operations, financial management, and sales and marketing.

Current Directorships: Director of Neurovance, Inc. and ImaginAb Inc.

Former Directorships:Director of Lantheus Medical Imaging, Inc.

Michael P. Kaminski, age 55, has been the Company’s President and Chief Executive Officer, and a member of the Board of Directors, since October 2015. Mr. Kaminski joined the Company in April 2013 as President, Radiation Measurement. He was President and Chief Executive Officer of Stereotaxis, Inc., a healthcare technology company specializing in the development of robotic cardiology instrument navigation systems, since 2009 and held other senior positions there since 2002. Prior to joining Stereotaxis, Mr. Kaminski spent nearly 20 years with Hill-Rom Company (Hillenbrand Industries), where he held several senior level positions. Mr. Kaminski earned a Bachelor of Science in marketing from Indiana University and an MBA from Xavier University.

Qualifications: Mr. Kaminski has extensive experience as a senior executive with a deep understanding of the Company’s business and its customers, successfully driving innovation and market development and implementing lean processes. His in-depth knowledge of our corporate strategy and management team resulting from his leadership position at our company, along with his management abilities and experience and his extensive knowledge of our industry gained from other senior executive roles, qualify Mr. Kaminski to serve as a member of our Board of Directors.

Current Directorships: None

Former Directorships: From 2008 to 2013, Director of Stereotaxis, Inc.; and Director of two non-profit organizations.

Director Nominees:

| | |

| 6 | |  |

| | |

| |

Election of Directors | | | PROXY STATEMENT |

Robert J. Cronin (3)

| | | |

Since 2001, Managing Partner, The Open Approach LLC, a provider of consulting services and investment banking to the printing industry. From November 2005 to April 2006, Chairman and Chief Executive Officer, York Label, Inc., a supplier of pressure-sensitive labels and related systems. Until January 2000, Chairman of the Board and Chief Executive Officer of Wallace Computer Services; previously President, Chief Executive Officer and Director; now retired. Wallace Computer Services is a provider of information management products, services and solutions.

|

Qualifications: Mr. Cronin’s experience as a Chairman and Chief Executive Officer at two companies provides valuable insight for the Company as to the issues and opportunities facing the Company, as well as experience in strategic planning and leadership of complex organizations. He also has considerable corporate governance experience through years of service in leadership positions with various public companies.

|

Current Directorships: Director of various privately held corporations.

|

Former Directorships: None

|

Age: 69

|

Director Since: 1997

|

Expiration of Current Term: 2014

|

| | | |

| | | |

William G. Dempsey (2,3)

| | | |

Since 2007, retired and serving as Director of various public and private companies. From 1982 to 2007, various senior leadership positions with Abbott Laboratories including Executive Vice President, Global Pharmaceuticals from 2006 to 2007. Abbott Laboratories is a global, broad-based health care company devoted to discovering new medicines, new technologies and new ways to manage health. From 1977 to 1982, various positions with Sciaky Bros., a manufacturer of high tech electron beam, laser welding and heat treating systems.

|

Qualifications: Mr. Dempsey’s extensive experience as a senior executive with a global pharmaceutical company provides a wealth of health care experience in global healthcare markets including pharmaceuticals, nutrition and medical devices. Mr. Dempsey’s leadership experience provides expertise in strategy, marketing, international operations, manufacturing and managing research and development organizations.

|

Current Directorships: Director of Nordion, Inc., a global leader in technologies for use in medical imaging and radiotherapeutics, and sterilization technologies; Director of Hospira, Inc.; and Director of a privately held corporation.

|

Former Directorships: None

|

Age: 62

|

Director Since: 2008

|

Expiration of Current Term: 2014

|

| | | |

| | | |

William E. Saxelby

| | | |

Since 2005, President and Chief Executive Officer, Landauer, Inc. From 2003 to 2005, Mr. Saxelby provided consulting services to certain private equity firms. From 1999 to 2003, President and Chief Executive Officer, Medical Research Laboratories, Inc., a manufacturer of defibrillators. From 1996 to 1999, Corporate Vice President, Allegiance Healthcare, a spin-off of Baxter International. From 1978 to 1996, Mr. Saxelby held executive and non-executive positions with Baxter International and its American Hospital Supply subsidiary.

|

Qualifications: Mr. Saxelby’s day-to-day leadership as President and Chief Executive Officer of the Company, as well as his many years of experience in the healthcare industry, provides him with deep knowledge of the Company’s operations and industry and gives him unique insights into the Company’s challenges and opportunities.

|

Current Directorships: None

|

Former Directorships: None

|

Age: 57

|

Director Since: 2005

|

Expiration of Current Term: 2014

|

Directors Continuing in Office:

| | | |

| | | |

Michael T. Leatherman (1,2)

| | | |

From September 2011 through December 2011, Interim Chief Financial Officer, Landauer, Inc. Since 2000, Independent Consultant primarily to the information technology industry. From 1990 to 2000, various senior leadership positions with Wallace Computer Services including Executive Vice President, Chief Information Officer and Chief Financial Officer from 1998 to 2000. From 1984 to 1990, Chief Executive Officer of FSC Paper Corporation, a subsidiary of Smorgon Consolidated Industries. Mr. Leatherman is a Certified Public Accountant.

|

Qualifications: Mr. Leatherman’s extensive experience as a senior executive with a wealth of information technology knowledge provides expertise in information systems strategy and project implementation, as well as expertise in general operational and strategic leadership. In addition, he brings financial acumen to Board discussions by virtue of his background as a Chief Financial Officer.

|

Current Directorships: None

|

Former Directorships: From 2006 to 2009, Director of Nashua Corporation, which was acquired by Cenveo, Inc.; and Director of a non-profit organization providing continuous care retirement services.

|

Age: 60

|

Director Since: 2008

|

Expiration of Current Term: 2016

|

| | | |

| | | |

David E. Meador (1,3)

| | | |

Since 2001, Executive Vice President and Chief Financial Officer, DTE Energy. From 1997 to 2001, Vice President and Controller, DTE Energy. DTE Energy provides safe, reliable electric and natural gas services to Michigan businesses and homes and has energy related businesses and services nationwide. From 1983 to 1997, served in a variety of financial and accounting positions at Chrysler Corporation. Mr. Meador began his professional career with Coopers and Lybrand and is a Certified Public Accountant.

|

Qualifications: Mr. Meador’s experience as a senior executive with an energy company provides substantial experience in the Nuclear Power industry. Mr. Meador’s role as an active executive provides a perspective of a leader familiar with many facets of an enterprise facing the same set of current external economic and governance issues. In addition, he brings financial acumen to Board discussions by virtue of his background as a Chief Financial Officer.

|

Current Directorships: None

|

Former Directorships: None

|

Age: 56

|

Director Since: 2008

|

Expiration of Current Term: 2016

|

| | | |

| | | |

Stephen C. Mitchell (2,3)

| | | |

Since 2001, President, Knight Group LLC, a privately held firm providing services for the start-up and management of new ventures. Since 1995, Vice Chairman and Director, Knight Facilities Management, Inc., a company providing outsourcing of facilities management services for industrial and commercial clients worldwide. Until 2001, President, Chief Operating Officer and Director, Lester B. Knight & Associates, Inc., a company involved in the planning, design and construction of advanced technology research and development and manufacturing facilities.

|

Qualifications: Mr. Mitchell’s extensive leadership experience in various companies of diverse industry and size provides experience in operational and strategic leadership. He also has considerable corporate governance experience through years of service on other public company boards.

|

Current Directorships: Director of Apogee Enterprises, Inc., a manufacturer of glass products for the construction and art framing markets.

|

Former Directorships: None

|

Age: 70

|

Director Since: 2005

|

Expiration of Current Term: 2015

|

| | | |

| | | |

Thomas M. White (1,2)

| | | |

Since 2007, Operating Partner for Apollo Management L.P., a private equity firm. Currently serving as Interim Chief Operating Officer of CEVA Logistics, an Apollo owned entity in the Netherlands, which provides contract logistics, freight forwarding and supply chain management services. During 2011 and 2012, Chief Financial Officer of Constellium, an Apollo owned entity in France, which produces aluminum products. During 2009 and 2010, Chief Financial Officer of SkyLink Aviation, Inc., an Apollo owned entity in Canada, which provides air charter logistics services. From 2002 to 2007, Chief Financial Officer of Hub Group, Inc., a NASDAQ listed company which provides logistics services. Prior to joining Hub Group, Mr. White was an audit partner with Arthur Andersen, which he joined in 1979. Mr. White is a Certified Public Accountant.

|

Qualifications: Mr. White’s extensive experience as a senior executive and Chief Financial Officer of global companies provides extensive knowledge in global operations, finance, international business and strategic planning. In addition, he brings financial acumen to Board discussions by virtue of his background as a Chief Financial Officer.

|

Current Directorships: Director of CEVA Group, PLC

|

Former Directorships: Director of Quality Distribution, Inc, a NASDAQ listed company; EVERTEC, Inc., a NASDAQ listed company; Director of FTD, Inc., a NYSE listed company and SkyLink Aviation, Inc.

|

Age: 56

|

Director Since: 2004

|

Expiration of Current Term: 2015

|

MemberMichael T. Leatherman, age 62, has been a director since 2008. Effective October 2015, Mr. Leatherman was appointed to the role of Executive Chairman of the (1) Audit Committee, (2) Compensation Committee, (3)Board of Directors of the Company. From December 2014 through September 2015, Mr. Leatherman served as President and Chief Executive Officer of Landauer, Inc. From September 2014 through December 2014, Mr. Leatherman was our Interim President and Chief Executive Officer, and from September 2011 through December 2011, he was Interim Chief Financial Officer of the Company. Since 2000, Mr. Leatherman has served as an Independent Consultant primarily to the information technology industry. From 1990 to 2000, Mr. Leatherman held various senior leadership positions with Wallace Computer Services including Executive Vice President, Chief Information Officer and Chief Financial Officer from 1998 to 2000. From 1984 to 1990, Mr. Leatherman was Chief Executive Officer of FSC Paper Corporation, a subsidiary of Smorgon Consolidated Industries. Mr. Leatherman is a Certified Public Accountant.

Qualifications: Mr. Leatherman’s extensive experience as a senior executive with a wealth of information technology knowledge provides expertise in information systems strategy and project implementation, as well as expertise in general operational and strategic leadership. In addition, he brings financial acumen to Board discussions by virtue of his background as a Chief Financial Officer.

Current Directorships: None

Former Directorships: From 2006 to 2009, Director of Nashua Corporation, which was acquired by Cenveo, Inc., a NYSE listed company; and Director of a non-profit organization providing continuous care retirement services.

Expiration of Current Term: 2016

David E. Meador, age 58, has been a director since 2008. Since 2014, Mr. Meador has served as Vice Chairman and Chief Administrative Officer, DTE Energy. Since 2001, Mr. Meador served as Executive Vice President and Chief Financial Officer, DTE Energy. From 1997 to 2001, Mr. Meador was Vice President and Controller, DTE Energy. DTE Energy provides safe, reliable electric and natural gas services to Michigan businesses and homes and has energy related businesses and services nationwide. From 1983 to 1997, Mr. Meador served in a variety of financial and accounting positions at Chrysler Corporation. Mr. Meador began his professional career with Coopers and Lybrand and is a Certified Public Accountant. Mr. Meador serves on the Governance and Nominating Committee and is Chairman of the Audit Committee.

Qualifications: Mr. Meador’s experience as a senior executive with an energy company provides substantial experience in the Nuclear Power industry. Mr. Meador’s role as an active executive provides a perspective of a leader familiar with many facets of an enterprise facing the same set of current external economic and governance issues. As Chairman of the Audit Committee, he has dedicated significant time and effort in overseeing improvements to the Company’s controlenvironment and risk assessment and to remediate the identified material weaknesses. In addition, he brings financial acumen to Board discussions by virtue of his background as a Chief Financial Officer.

Current Directorships: None

Former Directorships: None

Expiration of Current Term: 2016

| | |

| | 7 |

| | |

| |

PROXY STATEMENT | | Election of Directors |

DIRECTORS CONTINUING IN OFFICE:

Robert J. Cronin, age 71, has been a director since 1997. Since 2001, Mr. Cronin has served as Managing Partner, The Open Approach LLC, a provider of consulting services and investment banking to the printing industry. From November 2005 to April 2006, Mr. Cronin was Chairman and Chief Executive Officer, York Label, Inc., a supplier of pressure-sensitive labels and related systems. Until January 2000, Mr. Cronin was Chairman of the Board and Chief Executive Officer of Wallace Computer Services; previously President, Chief Executive Officer and Director; now retired. Wallace Computer Services is a provider of information management products, services and solutions. Mr. Cronin serves on the Audit and Governance and Nominating Committees and is the Lead Director of the Board of Directors.

Qualifications: Mr. Cronin’s experience as a Chairman and Chief Executive Officer at two companies provides valuable insight for the Company as to the issues and opportunities facing the Company, as well as experience in strategic planning and leadership of complex organizations. He also has considerable corporate governance experience through years of service in leadership positions with various public companies.

Current Directorships: Director of various privately-held corporations.

Former Directorships: None

Expiration of Current Term: 2017

William G. Dempsey, age 64, has been a director since 2008. Since 2007, Mr. Dempsey retired and has been serving as Director of various public and private companies. From 1982 to 2007, Mr. Dempsey held various senior leadership positions with Abbott Laboratories including Executive Vice President, Global Pharmaceuticals from 2006 to 2007. Abbott Laboratories is a global, broad-based health care company devoted to discovering new medicines, new technologies and new ways to manage health. From 1977 to 1982, Mr. Dempsey held various positions with Sciaky Bros., a manufacturer of high-tech electron beam, laser welding and heat treating systems. Mr. Dempsey serves on the Governance and Nominating Committee and is Chairman of the Compensation Committee.

Qualifications: Mr. Dempsey’s extensive experience as a senior executive with a global pharmaceutical company provides a wealth of health care experience in global healthcare markets including pharmaceuticals, nutrition and medical devices. Mr. Dempsey’s leadership experience provides expertise in strategy, marketing, international operations, manufacturing and managing research and development organizations.

Current Directorships: Director of Hill-Rom Holdings, Inc., a NYSE listed company. Mr. Dempsey also serves on the Salvation Army Advisory Board in Chicago and is a member of the Board of Trustees of the Guadalupe Center in Immokalee, Florida.

Former Directorships: Director of Hospira, Inc., a NYSE listed company; Director of MDS Inc.; Director of Nordion, Inc.; and Director of TYRX, Inc.

Expiration of Current Term: 2017

| | |

| 8 | |  |

| | |

| |

Election of Directors | | PROXY STATEMENT |

Stephen C. Mitchell, age 72, has been a director since 2005. Since 2001, Mr. Mitchell has served as President, Knight Group LLC, a privately-held firm providing services for the start-up and management of new ventures. Since 1995, Mr. Mitchell was Vice Chairman and Director, Knight Facilities Management, a company providing outsourcing of facilities management services for industrial and commercial clients worldwide. Until 2001, Mr. Mitchell was President, Chief Operating Officer and Director, Lester B. Knight & Associates, Inc., a company involved in the planning, design and construction of advanced technology research and development and manufacturing facilities. Mr. Mitchell serves on the Compensation Committee and is Chairman of the Governance and Nominating Committee.

Qualifications: Mr. Mitchell’s extensive leadership experience in various companies of diverse industry and size provides experience in operational and strategic leadership. He also has considerable corporate governance experience through years of service on other public company boards.

Current Directorships: None

Former Directorships: Director of Apogee Enterprises, Inc., a NASDAQ listed company.

Expiration of Current Term: 2018

Thomas M. White, age 58, has been a director since 2004. In January 2015, Mr. White became the Executive Chairman of Cardinal Logistics Holdings, LLC, which provides dedicated transportation and logistics services. From 2007 to 2014, Mr. White served as Operating Partner for Apollo Management L.P., a private equity firm. During 2013 and 2014, Mr. White served as Interim Chief Operating Officer of CEVA Logistics, an Apollo owned entity in the Netherlands, which provides contract logistics and freight forwarding services. During 2011 and 2012, he served as Chief Financial Officer of Constellium, an Apollo owned entity in France, which produces aluminum products. During 2009 and 2010, Mr. White served as Chief Financial Officer of SkyLink Aviation, Inc., an Apollo owned entity in Canada, which provides air charter logistics services. From 2002 to 2007, Mr. White served as Chief Financial Officer of Hub Group, Inc., a NASDAQ listed company which provides logistics services. Prior to joining Hub Group, Mr. White was an audit partner with Arthur Andersen, which he joined in 1979. Mr. White is a Certified Public Accountant. Mr. White serves on the Audit and Compensation Committees.

Qualifications: Mr. White’s extensive experience as a senior executive of global companies provides in-depth knowledge in global operations, finance, international business and strategic planning. In addition, he brings financial acumen to Board discussions by virtue of his background as a Chief Financial Officer.

Current Directorships: Director of CEVA Group, PLC and Cardinal Logistics Holdings, LLC.

Former Directorships: Director of Quality Distribution, Inc., a NASDAQ listed company; Director of EVERTEC, Inc., a NASDAQ listed company; Director of FTD, Inc., a NYSE listed company; and SkyLink Aviation, Inc.

Expiration of Current Term: 2018

There are no family relationships between any director or executive officer and any other director or executive officer of the Company.

| | |

| | 9 |

| | |

| |

PROXY STATEMENT | | Election of Directors |

EXECUTIVE OFFICERS

The executive officers of the Company are elected by its Board of Directors. Each serves until a successor is elected and qualified, or until the officer’s resignation or removal.

William E. Saxelby’s biographyMr. Kaminski’s and Mr. Leatherman’s biographies can be found in the Director Nominees“Director Nominees” section ofunder the Election of Directors section.Directors.

Position: Vice President, Chief Financial Officer and Secretary

Age: 41

Mr. Fujii has served as the Company’s Vice President, Chief Financial Officer and Secretary, as well as its principal financial officer, since April 2015. Prior to this appointment, Mr. Fujii served as Vice President, Corporate Controller and Chief Accounting Officer of the Company since April 2014. From January 2012 to March 2014, he was corporate controller of Actient Pharmaceuticals, LLC, a private specialty pharmaceuticals company that was acquired by Auxilium Pharmaceuticals, Inc. From October 2007 to January 2012, he was director of finance and controller for Nanosphere, Inc., a manufacturer of medical diagnostic equipment. Mr. Fujii’s experience includes financial leadership positions at several other publicly held organizations, including Richardson Electronics, Ltd., a provider of engineered solutions and distributor of electronic components to the electron device marketplace, and he began his career at PricewaterhouseCoopers LLP. He is a certified public accountant and earned a Bachelor of Science in accounting from the University of Illinois.

Position: Senior Vice President, Strategic Marketing and Product Development

Age: 57

Mr. Kennedy has served as Senior Vice President, Strategic Marketing and Product Development since April 2015. He was President of Landauer Medical Physics, a subsidiary of Landauer Inc., and Vice President Global Marketing for Landauer Inc. from August 2011 through April 2015. Mr. Kennedy has over 25 years of healthcare technology innovation and commercial leadership experience in both Fortune 500 and smaller private healthcare companies. Prior to joining Landauer, he held executive positions in strategic marketing, operations, product development, and general management at Baxter Healthcare, GE, and private healthcare companies. In these roles, he led significant medical device innovations and business transformations in dialysis, blood component therapy, inhaled drug delivery, and diagnostic imaging lifecycle management services. Mr. Kennedy earned a Bachelor of Science in chemical engineering from the University of Washington and an MBA from J.L. Kellogg Graduate School of Management at Northwestern University.

Position: Senior Vice President, Administration and Chief Information Officer

Age: 48

Mr. King has served as Senior Vice President, Administration and Chief Information Officer since April 2015. He was Vice President and Chief Information Officer of the Company since April 2009. Mr. King has over 20 years of experience in both Fortune 500 and smaller private manufacturing and industrial companies. Prior to Landauer, Mr. King held several Operations leadership roles, including Senior VP and Chief Information Officer, Senior VP of Sales and Marketing, Corporate Vice President of Operations, Director of Supply Chain Management, and Program Office Director. Mr. King earned a dual Masters Degree (MBA, MEM) from the J.L. Kellogg Graduate School of Management at Northwestern University, where he graduated with concentrations in Management & Strategy, Information Technology and Manufacturing Management. He also earned his Bachelor of Arts at Northwestern University.

| | |

| 10 | |  |

| | |

| |

Election of Directors | | | PROXY STATEMENT |

Michael K. Burke

| | | |

Mr. Burke joined the Company in January 2012 as Senior Vice President and Chief Financial Officer. Previously, he served as Senior Vice President and Chief Financial Officer of Albany International Corp., a global NYSE-listed company involved with advanced textiles and materials processing. Prior to his position at Albany, he was Executive Vice President and Chief Financial Officer of Intermagnetics General Corporation, a NASDAQ-listed company and a leader in the Magnetic Resonance Imaging (MRI) market. Prior to his time at Intermagnetics, he was Executive Vice President and Chief Financial Officer of HbT, Inc. Prior to joining HbT, Mr. Burke was a managing director within the U.S. Investment Banking Department of CIBC Oppenheimer Corp. (now CIBC World Markets).

|

Age: 55

|

Position: Senior Vice President and Chief Financial Officer

|

| | | |

| | | |

R. Craig Yoder

| | | |

Dr. Yoder was elected to his position in February 2001, after serving as the Company’s Vice President of Operations since 1994 and Technology Manager since joining the Company in 1983. Prior to joining the Company, he was a member of the senior technical staff at Pennsylvania Power and Light, and at Battelle Pacific Northwest Laboratory.

|

Age: 61

|

Position: Senior Vice President–Technology and International Business

|

| | | |

| | | |

Michael Kaminski

| | | |

Mr. Kaminski joined the company in April 2013 as President, Radiation Measurement. Previously he was Chief Executive Officer and President of Stereotaxis and held other senior positions there since 2002. Prior to joining the Company, Mr. Kaminski spent nearly 20 years with Hill-Rom Company (Hillenbrand Industries), where he held several senior level positions. Mr. Kaminski earned an M.B.A. from Xavier University and a B.S. in Marketing from Indiana University.

|

Age: 53

|

Position: President, Radiation Measurement

|

| | | |

| | | |

Michael Kennedy

| | | |

Mr. Kennedy has served since August 2011 as President of Landauer Medical Physics, a subsidiary of Landauer Inc., and Vice President Global Marketing for Landauer Inc. Mr. Kennedy has over twenty five years of healthcare technology innovation and commercial leadership experience in both Fortune 500 and smaller private healthcare companies. Prior to joining Landauer, he held executive positions in strategic marketing, operations, product development, and general management at Baxter Healthcare, GE, and private healthcare companies. In these roles, he led significant medical device innovations and business transformations in dialysis, blood component therapy, inhaled drug delivery, and diagnostic imaging lifecycle management services. Mr. Kennedy received a Bachelor of Science in chemical engineering from the University of Washington and an MBA from J.L. Kellogg Graduate School of Business at Northwestern University.

|

Age: 56

|

Position: President, Landauer Medical Physics and Vice President Global Marketing, Landauer Inc.

|

There are no family relationships between any director or executive officer and any other director or executive officer of the Company.

BOARD OF DIRECTORS AND COMMITTEES

During fiscal 2013,2015, the Board of Directors held a total of 65 meetings. No director attended fewer than 75 percent of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all Committees of the Board of Directors on which such director served during the periods that such director served.

The Board of Directors has an Audit Committee, Compensation Committee, and Governance and Nominating Committee. The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities with respect to financial reports and other financial information and recommends to the Board of Directors the appointment of independent public accountants. The Board of Directors has determined that Michael T. Leatherman,Jeffrey A. Bailey, Robert J. Cronin, David E. Meador and Thomas M. White each qualify as an “audit committee financial expert” as defined for the purpose of SEC regulation. The Compensation Committee approves all executive compensation and has responsibility for granting equity awards to eligible members of management and administering the Company’s equity and incentive compensation plans. The Governance and Nominating Committee establishes corporate governance policy and selects nominees for the Board of Directors. (See “Process for Nominating Directors.”) The membership of each Committee consists solely of non-employee directors who meet the independence standards established by the New York Stock Exchange (“NYSE”(the “NYSE”). During fiscal 2013,2015, the Audit Committee met 79 times including the meetings required to conduct its quarterly financial reviews, the Compensation Committee met 54 times, and the Governance and Nominating Committee met 45 times.

Each Committee has adopted a formal written charter, approved by the full Board of Directors, which specifies the scope of the Committee’s responsibilities and procedures for carrying out such responsibilities. A copy of each charter is available on the Company’s website athttp://www.landauer.com and printed copies are available from the Company on request. The Board of Directors has also adopted Governance and Nominating Standards, a Code of Business Conduct and Ethics applicable to all directors and employees and a Code of ConductEthics for Senior Financial Executives applicable to the principal executive, financial and accounting officers of the Company. Copies of each of these documents are available on the Company’s website athttp://www.landauer.com and printed copies are available from the Company on request. The Company intends to post on its website any amendments to its Code of Business Conduct and Ethics or Code of ConductEthics for Senior Financial Executives applicable to such senior officers.

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

The Board of Directors has determined that having an independent director serve as chairmanLead Director of the Board of Directors is in the best interest of stockholders at this time. The structure ensures a greater role for the independent directors in the oversight of the Company and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of the Board.Board of Directors. No single leadership model is right for all companies at all times, however, so the Board of Directors conducts an annual evaluation in order to determine whether it and its Committees are functioning effectively and recognizes that, depending on the circumstances, other leadership models might be appropriate. Accordingly, the Board of Directors periodically reviews its leadership structure.

The Board of Directors is actively involved in oversight of risks inherent in the operation of the Company’s businesses and the implementation of its strategic plan. The Board of Directors performs this oversight role by using several different levels of review. In connection with its reviews of the operations of the Company’s business segments and corporate functions, the Board of Directors addresses the primary risks associated with those segments and functions. In addition, the Board of Directors reviews the key risks associated with the Company’s strategic plan at an annual strategic planning session and periodically throughout the year as part of its consideration of the strategic direction of the Company.

The Board of Directors has delegated to the Audit Committee oversight of the Company’s risk management process. The Audit Committee (a) reviews with management the Company’s significant risk exposures and policies regarding the assessment and management of risk, (b) serves as an independent and objective body to monitor the Company’s financial reporting process and internal control systems, and (c) assists the Board of Directors in oversight of the Company’s compliance with legal and regulatory requirements. Each of the other Committees of the Board of Directors also oversees the management of Company risks that fall within the Committee’s areas of responsibility. The Governance and Nominating Committee oversees risks related to the Company’s governance structure and processes and the structure of the Board of Directors and its Committees to ensure appropriate oversight of risk. The Compensation Committee considers risks related to the design of the Company’s compensation program and arrangements for the Company’s named executive officers.

| | |

| | 11 |

| | |

| |

PROXY STATEMENT | | Election of Directors |

COMPENSATION RISK

Management has periodically undertaken, and the Compensation Committee has reviewed, an evaluation of Landauer’s compensation policies and procedures as they relate to risk management practices and risk-taking incentives. Based upon that evaluation, the Company has concluded that its compensation program does not create risks that are reasonably likely to result in a material adverse effect. In reaching this determination, the Company has taken into account the following design elements of Landauer’s compensation program and policies and practices: mixture of cash and equity payouts,payouts; mixture of performance time horizons,horizons; use of financial metrics that are easily capable of audit,audit; avoidance of uncapped rewards,rewards; use of required stock ownership amounts at senior management levels,levels; adherence to a broad clawback policy,policy; anti-hedging and anti-pledging policies; and a rigorous auditing, monitoring and enforcement environment.

INDEPENDENCE OF DIRECTORS

Under the Company’s Governance and Nominating Standards, a majority of the Board of Directors should be composed of Independent Directors as that term is defined in the NYSE listing standards. A director is independent under the NYSE listing standards if the Board affirmatively determines that the director has no material relationship with the Company directly or as a partner, stockholder or officer of an organization that has a relationship with the Company.

The Board has affirmatively determined that all directors, with the exception of William E. Saxelby,Michael T. Leatherman and Michael P. Kaminski, are considered independent under the independence standards of the NYSE. In reaching this determination, the Board considered the relationship of Mr. Dempsey’s membership on the board of a customer of the Company, and the relationship of one of Mr. Meador’s employer’s facilities as a customer of the Company. The Board determined that these relationships arewere not material.material in fiscal 2015. The Board has also concluded that no non-employee director has any of the disqualifying relationships identified by the NYSE. Consequently, the Board has determined that all non-employee directors are independent within the meaning of the NYSE listing standards. The Company’s independent directors are Jeffrey A. Bailey, Robert J. Cronin, William G. Dempsey, Michael T. Leatherman, David E. Meador, Stephen C. Mitchell, and Thomas M. White. Given histheir current employment by Landauer, William E. Saxelby isMichael T. Leatherman and Michael P. Kaminski are not at this time considered independent under the independence standards of the NYSE. The Company’s independent directors meet in regularly scheduled executive sessions and at other times, as they deem appropriate. Robert J. Cronin, ChairmanLead Director of the Board of Directors, presides at these sessions.

PROCESS FOR NOMINATING DIRECTORS

Landauer’s Governance and Nominating Committee establishes and oversees adherence to the Board’s Governance and Nominating Standards, and establishes policies and procedures for the recruitment and retention of Board members. The Governance and Nominating Committee is comprised of threefour members, each of whom meets the independence requirements established by the NYSE with respect to Governance and Nominating Committees.

The Governance and Nominating Committee will consider nominees for the Board of Directors who have been properly and timely recommended by stockholders. Any recommendation submitted by a stockholder must include the same information concerning the candidate and the stockholder as would be required under Section 1.4 of the Company’s by-laws if the stockholder were nominating that candidate directly. Those information requirements are summarized in this Proxy Statement under the caption “Stockholder Proposals.” The Governance and Nominating Committee will apply the same standards in considering director candidates recommended by stockholders as it applies to other candidates. The Governance and Nominating Committee has not established any specific, minimum qualification standards for nominees to the Board.Board of Directors. From time to time, the Governance and Nominating Committee may identify certain skills or attributes (e.g., healthcare industry experience, technology experience, financial experience) as being particularly desirable for specific director nominees. The Governance and Nominating Committee considers diversity of backgrounds and viewpoints when considering nominees for director but has not established a formal policy regarding diversity in identifying director nominees.

| | |

| 12 | |

|

| | |

| |

Election of Directors | | PROXY STATEMENT |

To date, the Governance and Nominating Committee has identified and evaluated nominees for director positions based on several factors, including: referrals from management, existing directors, advisors and representatives of the Company or other third parties; business and board of director experience; professional reputation; and personal interviews. Each of the current nominees for director listed under the caption “Election of Directors” is an existing director standing for election, in accordance with the Company’s amended by laws, or re-election.

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

BY STOCKHOLDERS AND OTHER INTERESTED PARTIES

The Company’s Annual Meeting of Stockholders provides an opportunity each year for stockholders and other interested parties to ask questions of or otherwise communicate directly with members of the Company’s Board of Directors on matters relevant to the Company. Each of the Company’s directors is requested to attend the Annual Meeting in person. All of the Company’s directors then in office attended the Company’s 20132015 Annual Meeting of Stockholders. In addition, stockholders and other interested parties may, at any time, communicate in writing with the full Board of Directors, any individual director or any group of directors, by sending such written communication to the full Board of Directors, individual director or group of directors at the following address: Landauer, Inc., 2 Science Road, Glenwood, Illinois 60425; Attention: Corporate Secretary. Copies of written communications received at such address will be provided to the addressee unless such communications are considered, in the reasonable judgment of the Corporate Secretary, to be improper for submission to the intended recipient(s). Examples of such communications that would be considered improper for submission include, without limitation, customer complaints, solicitations, communications that do not relate directly or indirectly to the Company or the Company’s business or communications that relate to improper or irrelevant topics.

| | |

| | 13 |

| | |

| |

PROXY STATEMENT | | Executive Compensation – Compensation Discussion and Analysis |

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

COMPENSATION DISCUSSION AND ANALYSIS

Landauer is required to provide information regarding the compensation program in place for its CEO, CFOChief Executive Officer (“CEO”), Chief Financial Officer (“CFO”) and the three other most highly compensated executive officers as of its last fiscal year end as well as certain other persons specified in SEC rules. Information regarding the compensation paid to these individuals is included inIn this Proxy Statement. In this proxy statement,Statement, the Company refers to the individuals as to whom compensation disclosure is required as the “Named Executive Officers” or “NEOs.” Our NEOs for the fiscal year ended September 30, 2015 are as follows:

Michael T. Leatherman, Interim President and Chief Executive Officer (September 15, 2014 through December 14, 2014) and President and Chief Executive Officer (effective December 15, 2014 through September 30, 2015);

Daniel J. Fujii, Vice President, Chief Financial Officer and Secretary (effective April 15, 2015);

Michael P. Kaminski, President, Radiation Measurement (through September 30, 2015; President and Chief Executive Officer from October 1, 2015 – present);

Michael R. Kennedy, Senior Vice President, Strategic Marketing and Product Development (effective April 1, 2015);

G. Douglas King, Senior Vice President, Administration and Chief Information Officer (effective April 1, 2015);

R. Craig Yoder, former Senior Vice President – Technology and International Business (through February 9, 2015); and

Mark A. Zorko, former Interim Chief Financial Officer (through April 15, 2015).

The following Compensation Discussion and Analysis (“CD&A”) describes our fiscal 2015 executive compensation program. This section includes information regarding, among other things, the overall philosophy of the Company’s executive compensation program and each element of compensation that it provides to executives, including our NEOs. This CD&A is intended to be read in conjunction with the tables beginning on page 29, which provide detailed historical compensation information for our NEOs.

Executive Summary

EXECUTIVE SUMMARY

The elements of Landauer’s compensation program for NEOs includecomprise: base salary,salary; annual non-equity incentive compensation (“annual bonus”); long-term equity incentive compensation; retirement plans; and post-termination compensation. During fiscal 2014, the Compensation Committee undertook an in-depth review of the Company’s compensation policies and practices and continued dialogue with stockholders regarding its compensation policies. As a result of this review and dialogue, the Compensation Committee modified the Company’s compensation policies in fiscal 2014. These modifications included:

an Amendment to the Company’s Incentive Compensation Plan and its Executive Special Severance Plan to provide for double trigger vesting of all future equity grants upon a change in control;

an Amendment to the Company’s Incentive Compensation Plan to provide that upon a termination of employment without cause, annual bonus and stock awards vest on a pro-rata basis based on service through the date of termination and in the case of performance-based awards, based on the lesser of actual performance (determined on the last day of the performance period) and target;

clarifying the Company’s policy and limiting the circumstances under which Landauer may make adjustments and amendments to performance measures for outstanding performance awards under the Company’s Incentive Compensation Plan;

| | |

| 14 | |  |

| | |

| |

Executive Compensation – Compensation Discussion and Analysis | | PROXY STATEMENT |

adding a peer group as a supplemental data point to assist with compensation decision-making; and

clarifying and expanding the Company’s anti-hedging policy and adopting an anti-pledging policy.

The Company also enhanced its compensation disclosures by adding a discussion regarding the addition of the peer group, which is available in the “Roles of Consultants and Executives” section. In addition, the Company modified its compensation design by adding two new performance metrics to the long-term incentive awards, including Cumulative Operating Cash Flow (“OCF”), which was initially added in fiscal 2014, and Return on Invested Capital (“ROIC”), which was added in fiscal 2015 and beyond.

During fiscal 2015, the Company further modified its compensation policies and practices. One such important change was to CEO compensation whereby the Compensation Committee modified the weighting of Mr. Leatherman’s fiscal 2015 long-term equity incentive compensation retirement benefitsopportunities during his appointment as President and severance arrangements.Chief Executive Officer, from a weighting of 70% performance-based vesting and 30% time-based vesting to 100% performance-based vesting, to focus the CEO on the Board’s strategic and financial objectives for the Company. The Compensation Committee consideredplans on reviewing a similar change in the resultsweighting of long-term equity incentive compensation opportunities for the non-binding advisory shareholder vote on executive compensation at our February 21, 2013 Annual Meeting of Stockholders, at which the overall compensationother NEOs as part of the Company’s Namedexecutive compensation program for fiscal 2016. The Compensation Committee also began utilizing a revised peer group in fiscal 2015 to benchmark NEO compensation using supplemental market data in addition to the biennial survey data and information about other relevant market practices and trends provided by its independent compensation consultant.

In each case, these changes further underscore the Company’s commitment to pay-for-performance and align the executive’s interests with those of our stockholders.

FISCAL 2015 DEVELOPMENTS AND COMPENSATION ACTIONS

During fiscal 2015, the Company made several significant management changes including: 1) the appointment of Mr. Fujii as Vice President, Chief Financial Officer and Secretary, as well as its principal financial officer; 2) the transition of Mr. Yoder, Landauer’s former Senior Vice President – Technology and International Business, to the role of Senior Technical Advisor; and 3) the transition of Mr. Zorko, the Company’s former Interim Chief Financial Officer, into an advisory role completing special projects. In addition, effective October 1, 2015, Mr. Leatherman stepped down as the Company’s President and Chief Executive OfficersOfficer and was approved by 96%appointed to the new position of Executive Chairman of the votes cast. GivenBoard. In connection with the high levelchange related to the position of stockholder support,Executive Chairman of the Compensation CommitteeBoard, Mr. Leatherman ceased participation in the Company’s Special Severance Plan and will not be eligible to receive an annual bonus in fiscal 2016. With the resignation of Mr. Leatherman as President and Chief Executive Officer, the Board of Directors determined that no significant changes toappointed Michael P. Kaminski as the Company’s executive compensation philosophynew President and principles were required duringChief Executive Officer.

Landauer performed below expectations in fiscal 20132015 and as a result, of the vote.